2024's Best CD Rates Connecticut Where To Invest Your Money Wisely

Beat the Market Madness Lock in 2024's highest best cd rates connecticut & conquer volatility Invest savvy & maximize your returns.

Dec 25, 20233.9K Shares265.6K Views

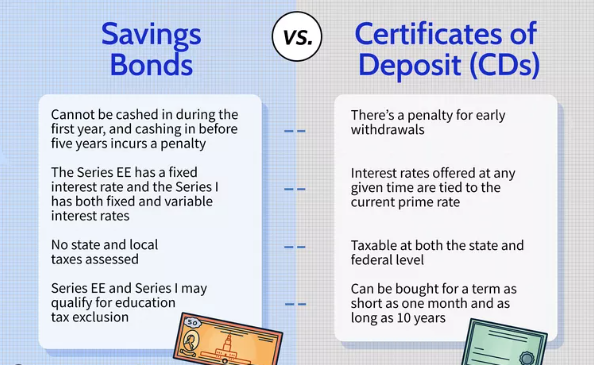

In a world of uncertain markets, one investment option continues to provide Connecticut residents with peace of mind: certificates of deposit, or CDs. These aren't your standard savings accounts; they're like a promise sealed in plastic, locking in your hard-earned money for a guaranteed term at a predetermined interest rate. Think of it as parking your funds in a safe haven and watching them grow steadily without the roller coaster ride of the stock market.

And in Connecticut, CDs find fertile ground. The state's conservative nature and risk-averse population appreciate the security and predictability CDs offer. They're ideal for those nearing retirement, building an emergency fund, or simply prioritizing steady returns over high-flying (and potentially heart-stopping) ventures. With CDs, your money rests easy, earning interest like clockwork—a comforting rhythm in the often-chaotic world of finances.

But that's just the tip of the iceberg. Let's dive deeper into why CDs are thriving in Connecticut and unlock the secrets to making them work for you.

Comparing Top Banks And Credit Unions In Connecticut For CD Rates

With so many options in the Connecticut CD landscape, navigating the best rates and terms can feel like a treasure hunt. But fear not, savvy seekers! We've unearthed the gold for you, comparing key banks and credit unions across the state to help you invest like a pro.

Rate Kings

- Santander Bank -reigns supreme with their 5.00% APY on 12-month Jumbo CDs, a beacon of stability in fluctuating markets.

- Navy Federal Credit Union -Close behind with their 4.95% APY on EasyStart Certificates, offering flexibility and decent returns even for smaller deposits.

- Charles Schwab Bank -A frontrunner for longer terms, their Schwab CD OneSource boasts a 5.51% APY for 5-year terms, ideal for long-term growth plans.

Term Twisters

- Chase Bank -caters to short-term savers with their 4.50% APY on 6-month CDs, perfect for parking emergency funds or bridging income gaps.

- Webster Bank -offers a unique "Bump-Rate CD," allowing one interest rate increase during the term if market rates climb—a gamble worth considering for the risk-tolerant.

- Connecticare Credit Union -Champions loyalty with their "Loyalty CD," rewarding long-term members with an extra 0.25% APY on top of their standard rates.

Feature Finders

- First Niagara Bank -simplifies life with their online CD opening process, saving you time and paperwork.

- People's United Bank -Entices high rollers with their Premier Certificate, offering tiered rates for deposits exceeding $250,000.

- Norwich Financial Federal Credit Union -Supports local education with their "FutureBuilder CD," with a portion of the interest going towards scholarships for local students.

Understanding CD Terms And Conditions

Certificates of Deposit (CDs) offer the sweet melody of guaranteed returns, but unlocking their full potential demands navigating their terms and conditions like a seasoned captain. Let's explore the key elements to consider in ensuring your financial voyage sails smoothly towards secure growth.

- Term Time -Like choosing a cruise itinerary, CDs come in various term lengths, each influencing the interest rate you'll enjoy. Short-term CDs, like 6-month or 1-year options, generally offer lower rates but provide quicker access to your funds. Mid-term stints, stretching from 2 to 4 years, sweeten the pot with higher rates, rewarding your commitment with steady growth. The granddaddy of CDs, the 5-year term, boasts the highest interest rates, making it ideal for long-term financial goals like retirement or a down payment.

- Maturity Matters -Remember the thrill of reaching your dream destination? Think of maturity as the CD's arrival date. It marks the completion of your chosen term, granting you unrestricted access to your principal and accumulated interest. Early withdrawal, however, is like changing ships mid-journey—it incurs penalties that bite into your hard-earned returns. These penalties typically decrease as your term progresses, so consider your liquidity needs carefully before setting sail.

- Early Exit Fees -Think of these as port taxes for premature disembarkation. They vary depending on the CD term and bank or credit union and can range from a few months' worth of interest to a hefty percentage of your principal. So, plan your financial voyage wisely to avoid these unnecessary stopovers.

- The Takeaway - Choosing the right CD term is a balancing act. Higher rates often come with longer lock-in periods, while shorter terms offer flexibility but lower returns. Assess your goals, risk tolerance, and potential need for early access before making a decision. Remember, consistency is key with CDs – treat them like a long-term commitment, and watch your money grow steadily with the sweet melody of compounding interest.

The Impact Of Economic Factors On CD Rates

While the interest rate plastered on your CD might seem like a fixed number, it's anything but. Behind the scenes, a complex dance of economic factors orchestrates the rhythm of your returns. Understanding how these forces play out is crucial for making informed CD choices.

The Maestro Of Rates The Federal Reserve

Think of the Fed as the conductor of the interest rate symphony. Their decisions on the federal funds rate set the baseline for borrowing costs across the entire financial system. When the Fed raises rates, banks generally follow suit, offering higher interest on deposit accounts like CDs to attract customers. Conversely, lower Fed rates can lead to stagnant or even decreasing CD rates.

Inflation's Double-Edged Sword

In a world with rising prices, simply earning interest isn't enough. You need your returns to outpace inflation to maintain purchasing power. So, when inflation rises, banks often raise CD rates to ensure their customers' money retains its value. However, if inflation outpaces rate hikes, your CD might still lose purchasing power over time.

Connecticut's Economic Climate

The local economic landscape also plays a role. A strong and growing Connecticut economy can lead to increased competition among banks and credit unions, driving CD rates up. Conversely, an economic slowdown might see banks offer lower rates to attract deposits and weather the storm.

Navigating The Economic Maze

- Stay informed -Keep an eye on the Fed's decisions, inflation trends, and economic forecasts for Connecticut.

- Shop around -Compare CD rates from different banks and credit unions to find the best deals, considering both current rates and projected economic trends.

- Think long-term -If you anticipate inflation or interest rate hikes in the future, consider locking in a longer-term CD with a higher guaranteed rate.

Advantages Of High-Interest CDs In Connecticut

In the land of steady living, Connecticut residents know a thing or two about making their money work. And when it comes to savings, high-interest CDs are like a secret stash of growth magic, quietly amplifying your financial firepower. So, let's ditch the low-yield doldrums and delve into the perks of these interest rate superheroes!

- Turbocharge Your Nest Egg -Retirement feels a lot closer when your savings are sprinting, not crawling. High-interest CDs act like rocket boosters, propelling your retirement fund towards freedom faster. Imagine: every extra percentage point means thousands more down the line, turning that cozy retirement beach into a tropical paradise!

- Emergency Fund Fortress -Life's curveballs don't come with an interest rate, but your emergency fund should. High-interest CDs provide a comfy safety net for unexpected expenses, ensuring you face them with a financial shield, not a bare wallet. Plus, the predictable returns mean you can budget with confidence, knowing your rainy-day fund is growing, not shrinking.

- Beat the Inflation Beast -In times of rising prices, even a regular CD might feel like a deflating balloon. But high-interest CDs fight back! Their extra oomph can outpace inflation, protecting your purchasing power and ensuring your hard-earned dollars retain their value. Think of it as inflation-proofing your future, keeping your dreams safe from the price-hike monster.

- Sleep Soundly, Grow Steadily -Unlike the volatile rollercoaster of the stock market, high-interest CDs offer the soothing melody of predictable growth. You lock in your rate, kick back, and watch your money blossom with the gentle rhythm of compound interest. It's financial peace of mind in a jar, letting you rest assured while your savings blossom.Finding Your CD Oasis:

- Connecticut Caliber -And here's the cherry on top! Connecticut boasts a competitive landscape for high-interest CDs, meaning you can find rates that truly pack a punch. With some savvy comparison shopping, you can unlock the potential to supercharge your financial goals, whether it's building a bigger retirement nest egg, fortifying your emergency fund, or simply giving your savings a much-needed boost.

Tips For First-Time CD Investors In Connecticut

Congratulations, Connecticut newcomer, on embarking on the rewarding journey of CD investing! But before you dive headfirst into this treasure trove of interest, let's equip you with the savvy to choose the perfect CD and avoid any rookie missteps. Here's your roadmap to CD mastery.

Finding Your CD Oasis

- Shop Around -Don't settle for the first bank you see! Compare rates and terms offered by different banks and credit unions. Connecticut's competitive landscape means big savings potential for the informed shopper.

- Know Your Term -Decide how long you're willing to commit your funds. Short-term CDs offer flexibility but lower returns, while longer terms lock in higher rates but restrict access. Choose a term that aligns with your goals, like saving for a car (3 years) or retirement (10+ years).

- Mind the Minimums -Some CDs have minimum deposit requirements, so ensure your starting stash fits the bill.

- Read the Fine Print -Penalties for early withdrawal can be brutal. Understand the terms and conditions before signing on the dotted line.

Picking The Perfect Pearl

- Rate Rockstar or Stability Saint -Prioritize high rates or predictable returns? If you need access soon, prioritize stability. For long-term goals, chase the rate rockstars.

- Compounding Conundrum -Choose a CD that compounds interest regularly, allowing your money to snowball over time.

- Bonus Features -Some CDs offer perks like add-on deposits or loyalty bonuses. Choose features that suit your needs and savings style.

Avoiding Common Slip-Ups

- Don't Over-diversify -Start with one or two CDs to get the hang of it. Too many can be hard to manage.

- Don't Forget the Ladder -If you have long-term savings goals, consider a "CD ladder" – invest in CDs with different maturity dates to access funds throughout your journey.

- Don't Panic Sell -Market fluctuations shouldn't dictate your CD decisions. Stick to your term unless a genuine emergency arises.

Online Banks Vs. Local Banks Where To Find The Best CD Rates

In the digital age, even the world of CDs has a battleground: online banks versus local brick-and-mortar institutions. But where do you, the savvy Connecticut saver, find the best rates and a comfortable fit for your CD needs? Let's dive into the pros and cons of each, with a special focus on their CD rate landscape.

Online Banks Pros

- Rate Royalty -Online banks often reign supreme in the rate game, offering significantly higher CD rates than their local counterparts. Think shiny pennies piling up faster!

- Convenience Craze -Skip the bank lines and manage your CD from the comfort of your couch. Online platforms are user-friendly and accessible 24/7.

- Location Liberation -No matter where you are in Connecticut, online banks are just a click away. Geographic limitations are a thing of the past.

Cons

- Touchless Transactions -No personal touch can feel impersonal, especially when it comes to complex financial decisions. Online support might not be as readily available as in local banks.

- Tech Tussles -Technical glitches or internet outages can be frustrating, potentially hindering access to your funds or account information.

- Local Connections Lacking -Building relationships with local bankers can be beneficial for personalized advice and support. Online banks might lack that community feel.

Local Banks Pros

- Familiar Faces -Local banks offer the comfort of knowing your banker and having a personal connection. They can provide tailored advice and support specific to your financial situation.

- Community Champions -Local banks often reinvest in the community, supporting local businesses and initiatives. Banking with them can feel like contributing to your neighborhood.

- Deposit Diversity -Some local banks offer a wider range of deposit options, including CDs, checking, and savings accounts, making them a one-stop shop for all your banking needs.

Second Cons

- Rate Royalty Gap -Local banks often struggle to compete with the high CD rates offered by online giants. You might sacrifice some growth potential for the comfort of a familiar face.

- Convenience Constraints -Brick-and-mortar hours can be limiting, especially if you work late or prefer late-night banking. Online access might be limited or nonexistent.

- Location Limitations -Finding a convenient local bank branch can be tricky, especially in rural areas. Online banks offer the luxury of banking from anywhere.

The Verdict

Choosing between online and local banks for CDs depends on your priorities. If high rates and convenience are your top concerns, online banks are the clear winners. But if you value personal connections, community involvement, and broader banking options, local banks might be a better fit.

Conclusion

So, there you have it, Connecticut saver! You're now armed with the knowledge and tools to navigate the exciting world of CDs and unlock their potential for financial growth. Remember, choosing the right CD is a personal journey, and the best option depends on your individual goals, risk tolerance, and financial priorities.

Whether you opt for the convenience and high rates of online banks or the personal touch and community involvement of local institutions, make sure you research your options, compare rates, and choose a bank that makes you feel confident and secure.

With the information in this guide as your compass, you're well on your way to finding the perfect CD and watching your savings blossom in the fertile ground of Connecticut's financial landscape. Happy investing, and remember, the future of your financial freedom is just a CD away.

Jump to

Comparing Top Banks And Credit Unions In Connecticut For CD Rates

Understanding CD Terms And Conditions

The Impact Of Economic Factors On CD Rates

Advantages Of High-Interest CDs In Connecticut

Tips For First-Time CD Investors In Connecticut

Online Banks Vs. Local Banks Where To Find The Best CD Rates

Conclusion

Latest Articles

Popular Articles